Leading Business Insolvency Company for Strategic Financial Administration

Leading Business Insolvency Company for Strategic Financial Administration

Blog Article

Look Into the Intricacies of Insolvency Services and Exactly How They Can Offer the Assistance You Need

Browsing the intricacies of bankruptcy can be an overwhelming task for individuals and businesses alike. When monetary difficulties impend huge, seeking the support of insolvency services comes to be vital in discovering a way onward. These solutions offer a lifeline for those facing frustrating financial obligation or financial distress, supplying an array of services customized to each special circumstance. Understanding the complexities of bankruptcy solutions and exactly how they can supply the needed support is vital to making educated choices throughout challenging times. In exploring the numerous elements of bankruptcy solutions and the advantages they bring, a more clear path to economic stability and recovery arises.

Understanding Insolvency Solutions

One trick facet of understanding bankruptcy services is acknowledging the different insolvency procedures offered under the law. For people, alternatives such as individual voluntary setups (Individual voluntary agreements) or bankruptcy might be considered, while organizations may check out firm voluntary setups (CVAs) or administration. Each choice comes with its own collection of needs, ramifications, and possible results, making it vital to seek expert advice to make enlightened decisions.

Moreover, bankruptcy professionals can supply beneficial suggestions on handling financial institutions, working out settlements, and restructuring financial debts to accomplish economic stability. By understanding bankruptcy services and the assistance they use, businesses and people can navigate difficult economic conditions with self-confidence and clarity.

Kinds of Insolvency Solutions

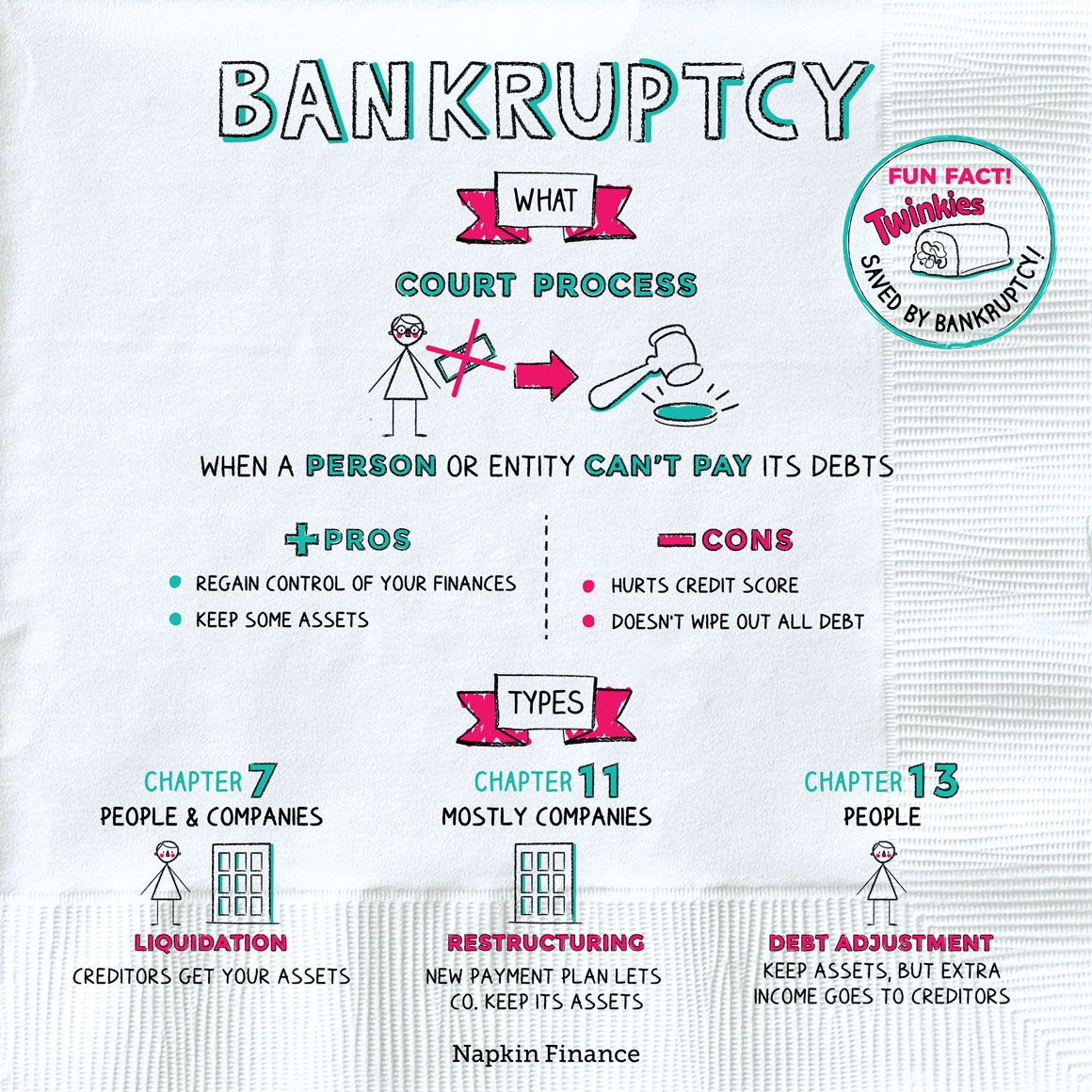

What are the unique kinds of insolvency solutions readily available to individuals and services in monetary distress? When faced with insolvency, there are numerous paths that individuals and services can take to resolve their monetary obstacles.

Another insolvency remedy is a Specific Volunteer Arrangement (INDIVIDUAL VOLUNTARY AGREEMENT), an official agreement between an individual and their financial institutions to repay financial obligations over a specific period. IVAs supply a structured method to manage financial debt while preventing bankruptcy.

For organizations, management is a type of bankruptcy option that includes selecting an administrator to look after the business's events and work in the direction of a recuperation or orderly winding up of business. This can assist businesses in financial distress restructure and potentially prevent closure. Each of these bankruptcy services uses a various technique to fixing monetary problems, satisfying the special needs of businesses and people facing bankruptcy.

Benefits of Seeking Specialist Help

Looking for specialist aid when browsing bankruptcy can offer individuals and organizations with specialist advice and calculated remedies to effectively manage their monetary obstacles. Insolvency professionals bring a wealth of experience and expertise to the table, providing customized suggestions based upon the details conditions of each instance. By enlisting the services of bankruptcy specialists, customers can benefit from an organized strategy to fixing their financial difficulties, making sure that all available choices are checked out and one of the most viable remedy is sought.

In addition, expert insolvency professionals have a deep understanding of the regulative and lawful frameworks surrounding insolvency proceedings. This competence can be invaluable in making certain compliance with pertinent legislations and policies, lessening the danger of costly errors or oversights throughout the insolvency process.

Additionally, involving professional aid can aid minimize the stress and anxiety and burden connected with insolvency, enabling people and organizations to concentrate on rebuilding their financial wellness (Business Insolvency Company). The support and support offered by have a peek at these guys insolvency experts can infuse confidence and clarity in decision-making, equipping clients to browse the complexities of insolvency with better ease and efficiency

Significance of Timely Intervention

Having actually acknowledged the benefits of specialist assistance in managing monetary obstacles throughout insolvency, it becomes critical to emphasize the critical significance of timely treatment in such conditions. By acting immediately and engaging insolvency solutions at the earliest signs of financial distress, people and organizations can access tailored remedies to resolve their certain demands and navigate the complexities of insolvency procedures a lot more properly.

Prompt treatment demonstrates a dedication to addressing financial challenges properly and ethically, instilling self-confidence in stakeholders and fostering trust in the bankruptcy process. In verdict, the relevance of prompt intervention in insolvency can not be overstated, as it offers as an important element in establishing the success of monetary recovery initiatives.

Browsing Insolvency Procedures

Effective navigating through bankruptcy procedures is vital for people and organizations dealing with monetary distress. The very first action in browsing bankruptcy treatments is generally examining the financial situation and figuring out the most ideal program of action.

Involving with insolvency professionals, such as certified insolvency professionals, can offer important guidance throughout the procedure. By understanding and efficiently navigating insolvency people, services and treatments can work towards settling their monetary difficulties and attaining a fresh begin.

Verdict

In verdict, bankruptcy solutions play a vital role in supplying required assistance and support during tough economic scenarios. By seeking expert help, people and businesses can navigate bankruptcy procedures efficiently and check out numerous services to address their economic obstacles. Timely treatment is type in avoiding further problems and securing a much better economic future. Comprehending the details of bankruptcy solutions can assist people make informed choices and take control of read the full info here their financial wellness.

One secret facet of recognizing insolvency services is acknowledging the various bankruptcy treatments readily available under the legislation. Each of these insolvency services offers a different approach to solving financial problems, providing to the unique needs of companies and individuals facing insolvency.

Involving with insolvency specialists, such as licensed bankruptcy experts, can give important advice throughout the procedure.

Report this page